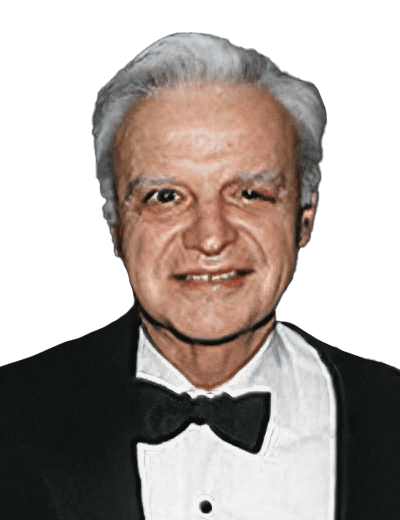

John Rigas passed away on Thursday, Sept. 30, 2021.

Interview Date: October 17, 2000

Interviewer: Marlowe Froke

2001 Cable Hall of Fame Honoree

FROKE: John Rigas is one of the classic entrepreneurs, not only in the cable television industry, but in business and industry in general in the United States and even on a world-wide basis. Starting out with a small cable operation in Coudersport, Pennsylvania and then seeing it develop into a national and international multi-media, multi-telecommunications operation from an operation that had difficulty financially beginning, Adelphia Communications is now a multi-billion dollar operation that everybody is familiar with. John Rigas is regarded as “the” person to whom the cable industry looks these days not only for where the cable industry will be going in the years ahead, but also reflections and nostalgia about the past. We’re fortunate to be with John in the Brown Barn in Coudersport, Pennsylvania.

John, how did you choose the name Brown Barn for this particular facility here in Coudersport?

RIGAS: Well, this used to be a barn that housed cows.

FROKE: It really was?

RIGAS: Yes it was a barn. I decided to save the barn, but I made one mistake – I asked my wife to help me restore it. It turned out what you have now.

FROKE: It’s a spectacular facility.

RIGAS: But it was a brown barn when we first had it, and it’s a brown barn today.

FROKE: When you gave me a tour of some of the space here in the Brown Barn, you showed me then a recreational facility where you have the opportunity to bring the family together for exercise and recreation. Is the brown barn, then, something of a family facility? Is that how you envision it or is an organization/administration building?

RIGAS: No, it’s really the family more than the organization although we’ll have company gatherings here. It really was put together for the family to invite who they wanted to to participate in some sporting events our there in the little gym and play basketball and birthday parties. Then upstairs we have a couple of apartments that our guests can stay in.

FROKE: It’s a spectacular facility. It really is.

RIGAS: Okay. So now I suppose I ought to invite everybody to the Brown Barn.

FROKE: You’ll get requests for invitations now from people all over the country so that they can experience what I experienced on this, the 17th of October in the year 2000. How many years have you been in the cable business, John?

RIGAS: Well, you know, I guess 48. It will be 50 in 2002.

FROKE: So you were there at the very beginning as the historians of the cable industry are saying these days. 1948?

RIGAS: Yes, you know, when I look back now – and there isn’t a day that my mind doesn’t reflect on the early days and those early pioneers and Pennsylvania was such a big part of the cable industry. I just can’t help back and think back and realize how much they did for me and for cable television because those early pioneers were truly extraordinary people. They just had such a passion and believed in what they were attempting to do and with very little skills as far as having the latest state-of-the-art equipment to work with. So you know, I must say that those days were something special. I wasn’t at the very beginning in ’48-’49 but certainly in ’52 was close enough. I’m just so lucky that I’ve met so many people in this industry, growing up together. And I’m still here.

FROKE: And you’re talking about such people as Bob Magness and Bill Daniels and George Barco.

RIGAS: Sure. You know, I’m talking about – if I’m looking back to when I got started in ’52 – I’m talking about people like Bob Tarleton and John Walson and George and Yolanda Barco and Milt Shapp and Joe Gans and George Gardner and Marty Malarkey. The list goes on and on and I wished I could name them all. But they’re the group that were from Pennsylvania that I remember so well in the early, early days. Of course, there were Bill Daniels at the national scene, and Bob Magness. But my personal contacts at the beginning were with the Pennsylvania group.

FROKE: What is there about the cable industry that prompts such a family-type comment as you just made in reflecting on the professional relationships that you had? You were very, very close to these people.

RIGAS: I think that there was such a close bond because you must remember we were a small group of people. We had so many adversaries and so many uncertainties that we had to lean on each other for support and encouragement and leadership. So that bond and that family relationship meant so much. I think that when I look back on it, it’s still is there – that whole culture that has come through this industry these many years. When I talk about the people that I mention in the past and then I go on and there’s another generation that in the 60’s and the 70’s that came on board – Ralph Roberts, Julian Brodsky,

FROKE: Jim Robbins.

RIGAS: Yes. Amos Hostetter, Alan Gerry. The list goes on – Ed Allen. I could name a whole lot of those people that carried the burden. I wouldn’t want to be the one that suggested that I was a leader in that endeavor. I was always a big believer in the cable industry. But I needed people like those people that were great mentors to me. I’ve just been lucky. I can reflect on those days, and I draw on that experience and how they felt about issues and the industry that has sustained me these many years – very important. I’ve been very lucky.

FROKE: The year 2000 has been an exceptional year for you in terms of the cable industry, recognizing your contributions. You were the recipient of the Vanguard Award, the recipient of the Operator of the Year Award. You were the recipient of the Kaitz Award. It was a big year for you.

RIGAS: There’s something to be said about hanging around long enough, and I’m a perfect example of that. Ten years ago I used to tell people that as I’ve gotten older, people have given me an awfully lot of recognition and respect. I get a lot of perks along the way. I’m going to stick around and enjoy all that. And I have enjoyed it. I must say that as I known this industry and stayed around, yes, you get a lot of recognition. But I also know that part of that is the longevity of being around, and I recognize that. But at the same time, those awards I don’t take lightly because they are important, and I appreciate the people recognizing me. It means a lot to me.

FROKE: You’re being over modest again as you always have been, John, in that it is a miracle what you have accomplished with Adelphia Communications Corporation.

RIGAS: Well, it probably is a miracle because I never expected to survive so many days.

FROKE: You presided over it. I noticed in the background, for instance, a picture of you and the pope shaking hands. So he must have been sanctifying the miracle that took place.

RIGAS: I often said that praying helped. There were times that I did a lot of praying.

FROKE: Let’s go back to those early days when probably you prayed more. Well, I won’t say that. Maybe you pray more today than you did then. I don’t know. At any rate, it was an inappropriate remark so let’s pass it just as quickly as we can. What part of the country were you born in? You’re not a native of Pennsylvania are you?

RIGAS: Sure. I was born just across the border here. Where Coudersport is located, we’re just 12 miles from the New York state line. So I was born about 30 miles from here in Wellsville, New York, population about 7,000 people. It’s in the western part of the state. My parents were Greek immigrants. My father came to this country in 1912 and so many immigrants came here with just a dream and an awfully lot of courage, a lot of faith. My mother came to this country in 1920.

FROKE: Also from Greece?

RIGAS: Also from Greece – from the same village. And I ought to repeat a little story because sometimes we lose perspective of what people were called on as immigrants to do and the great commitment they had. If you can visualize my little mother as a little girl growing up in this little village up in the mountains of Greece where there was no electricity, no plumbing, no roads, no hospital, just if you pass over the mountain tops. Education was over for her when she was in third grade. When she was 19 years old in the village, she was of course doing what was expected of the older child – helping to raise the other children and take care of them. She got a letter from America asking for her to come to this country to become the bride of who was my dad. Of course, mom had never known my dad except they knew the families in the village. Both families talked it over. With a pitcher in her hand and strong commitment to family and strong faith in her religion, she hiked 75 miles down to that seaport, took the boat over to New York, came through Ellis Island, was greeted by my dad and a few relatives from the village, took the Erie Railroad to Wellsville. My dad had started a restaurant in 1921 as all good Greeks should do. Up over the restaurant, my mother and dad were married in the Greek Orthodox Church, and I was born over the restaurant. My brother has run that restaurant and now my nephew so it’s been in existence for close to 80 years and has become an institution. It gives my a lot of satisfaction and pride to be able to go back to the restaurant 2 – 3 times a week, see some old friends, and renew not only acquaintances but my roots which is important to me.

FROKE: Is the restaurant still owned by your family?

RIGAS: Yes, it’s still in the family so I can still go get a hot dog and a cup of coffee – for free.

FROKE: How many children were there in the family?

RIGAS: There were 4 of us. I’m the oldest. I have two sisters and a brother, all alive. My dad lived to be 87 and my mother lived to be 91 so they lived to be a good age and they were blessed. It is certainly a great story that so many immigrants can relate to in their lives. Being part of that immigrant experience, first generation, has certainly meant a lot to me. I think it also has guided me in how I deal with people and issues. So I’ve been very lucky to grow up in a little town, still close to home, and be here.

FROKE: How did you get to Coudersport?

RIGAS: Well, I got to Coudersport after I went in the service. I was discharged from the service in 1946 during World War II. I wouldn’t want anybody to misread it. I got to the high rank of PFC.

FROKE: Were you in the Army?

RIGAS: I was in the Army Infantry…

FROKE: I was too.

RIGAS: … and was overseas and came back.

FROKE: Germany?

RIGAS: Yes. We landed in France. I didn’t land at Normandy. I missed that part of it. But nonetheless, the war was over, and I was discharged. In my home town, there were three Greek boys who were three years older than I. They had started education at Renssalier Polytechnic Institute which was then an all boys school, all engineering primarily – a technical school. During the war, they had to leave. When the war was over, they went back to Renssalier to renew their education and get their degree. As a consequence, I didn’t know too much about one school from another and the GI bill was available which was very important to all of us. So if my Greek friends went to Renssalier, that’s where I went. I received my degree in engineering. But when I was there, I must say that there were many times that I was think about transferring out. Engineering wasn’t the easiest discipline for me.

FROKE: The physics and mathematics.

RIGAS: I got by. My simple observation was my roommates would turn off their lights at 12:30 and I’d still be studying and trying to solve that problem. They were getting a few more A’s than I was. So when I got graduated from college, I decided that perhaps I ought to look at a different world. I always had a desire to perhaps start something in the business world and go that direction rather than be part of the corporate make-up at that time. And jobs were scarce. So, putting that together, I made a kind of a career choice. That was, my dad said, “Why don’t you try the restaurant?” I put on the white apron and worked the grill, waited on the tables. I discovered that my dad had a talent that I didn’t have. He could go in the kitchen, and he could make up batter of pancakes and the chili sauce for the hot dogs and the custard pie and the apple pies. And somehow, it always came out better than what I had coming out. And he had a flavor for that, and I sensed that I really didn’t have what it really took to be part of that restaurant. So I was looking for something else.

FROKE: He enjoyed the enjoyment that people had in eating his food.

RIGAS: Yes. Working in a restaurant and working the grill is a wonderful place to meet so many great people at all levels. And the restaurant attracted at every level – the working man, the professional man. You got an opportunity, over a cup of coffee and over the counter when things were quiet, to chat and get to know people and families. I think it helped me with my ability to meet people, be comfortable and understand what people’s needs were. I think that listening to people in the restaurant helped me a lot. Anyway, what happened is that I had another Greek friend – the Greeks keep coming into the beginning of this story, but that’s part of my history. He was in the theater business. He said, “John, there’s this theater in Coudersport, Pennsylvania that’s for sale. You might consider looking at the theater business. Come on. The theater business is a good business.” So I went over and looked at it. It just so happened that the night I went over and looked at it and check out the house, it was full. I thought that was a good sign. But what I didn’t realize is that it was during deer season, and all the hunters were there packing up the theater. So that didn’t happen very often like that. We decided to see if we could buy the theater. I decided it was a start. It was a run-down theater, and it was a challenge. But my dad had a few dollars he could contribute. We went to the two local banks in town, and they did the right thing. They turned us down because it was a pretty poor investment, but funny how things worked out. The seller was anxious to get out for one reason or another so he was willing to take a lot of paper. We raised another $10,000 to make the down payment from two other Greek families in my hometown. They were willing to lend my dad and myself the necessary money. So that’s how I got into the theater business which we still have.

FROKE: I drove down the main street of Coudersport in coming to this meeting this morning, and the theater is still there and it looks in fine shape. The marquee is telling you that the shows are coming in. It’s still active. And you still get a full house occasionally.

RIGAS: Yes. Well that can be a little misleading because …

FROKE: But it sure looks good.

RIGAS: We get full houses because we allow all the people that work for Adelphia in for free. I’ll deviate from that a little bit.

FROKE: It’s one of their benefits.

RIGAS: Yes. It’s one of those benefits – and their families. So the other day I was talking to my manager, and I looked at the theater. It was pretty full. I said, “Well, must be that it’s a pretty popular movie and doing good business. How much are we taking in at the box office?” He said, “$37.50.” I got to thinking that maybe I have to review that whole policy because we might be crowding people out of there. I don’t know. I have to …

FROKE: It’s become another part of the magnificent philanthropy that you have shown to your community. We’ll talk about that at a later time. But the theater now becomes a cultural resource for the community as a whole.

RIGAS: Yes. But getting back so I can finish up so some people want to put in the right perspective. It was a poor investment because television was going to come in which was impressive. And I knew that the box office was going to be hurt from that. In regard to the theater, it really was a run-down theater. There wasn’t anything that anybody could be proud of. But as I thought about it, it was a career choice. On reflection, it certainly turned out well for me. Sometimes, as young people, we have to make a choice to start with a whole lot less and fulfill some of our dreams and hopes. But you can’t start with a prestigious job always. You have to stretch it a little bit and make a sacrifice. Certainly in my case with my makeup and personality, that was the right career choice for me to start off, as discouraging as it looked at that time. I can well remember that first day in the box office, selling those tickets, in debt, knew nothing about the theater business, making the popcorn, taking the tickets, ushering people. “Why did I do this?” But there was something that said that I just wanted to try something on my own. So that’s where it came from.

FROKE: And it turned out that the presentation business in the motion picture industry became a very significant part of the cable industry.

RIGAS: Sure. I booked the movies, made the popcorn …

FROKE: And the experience was relevant to cable.

RIGAS: Yes.

FROKE: Were you married to Doris at the time that you came to Coudersport?

RIGAS: No. I wasn’t. I was single. What happened is that there was a film salesman … the story is an example of a person being at the right place at the right time. Perhaps there’s somebody up there having a mission and a reason. I’ve got to believe that because I’ve had too many situations in my life that there hadn’t been a purpose. So having said that, there was a film salesman by the name of Sam Milburg. Sam Milburg came from a family that was film peddlers – his parents were. In those days, the salesman and the film industry had an awfully lot of pride and prestige. It was a real, real pleasure and privilege to be part of that industry. Sam had that in him. On the other hand, if you went to breakfast with Sam, he’d be liable to spill egg on his tie. He would insult the waitress, never pay the check, and then light up a cheap $.05 cigar and smell up the whole place. You would say, “Why in the world would you bother with Sam?” He represented RKO Pictures in those days. But Sam had something special. He took a liking to me, and I needed somebody that understood the business and help me along. So what he did for me was give me examples of what I should book and what I shouldn’t book. As an example, he would say to me, “John, don’t book that picture from MGM.” MGM was a premier film distribution company and producer of films, and MGM had all the big stars. But he would say, “Well, they’re going to ask a lot of money for this picture. Joan Crawford doesn’t do well in a small town. I’ve got a picture, “Tarzan of the Apes”. I’ll sell it to you for $12.50. You can go over to Republic, and they’ve got Gene Autry and Roy Rogers. That’s take $12.50. And for $25 you’ve got a double feature that will do well in Coudersport.” So I got to appreciate what the Bongos and Ma and Pa Kettles, the Bowery Boys meant in a small town in those days. Sam also did this. For some reason that I’ve never been able to figure out, Sam would say, “John, I’ve been traveling through small towns in Pennsylvania. A couple of these small towns are bringing in television by wire. That’s the future. You have to get the franchise.” We called it a license. He wasn’t sure. He said, “You have to get permission to cross the streets.” He wasn’t sure what it all entailed. “But get it because your box office is going to be impacted with television coming. I’ve seen the results as I’ve traveled this district up here. When television comes in, the box office just drops right off. So in order to protect yourself, get that license.” Now at this point in my life, I wasn’t married, but I had a big debt.

FROKE: From the motion picture theater.

RIGAS: From the motion picture theater – all leveraged, very little down payment and a lot of uncertainty because I knew television was going to come in, and I was trying to pay down the debt as fast as I could. But I also took a job traveling 30 miles to Emporia, Pennsylvania as an engineer. Then I’d come back at night, open up the theater, do whatever it took, close it up, trying to make ends meet. I said, “Sam, you know I don’t have any time for this endeavor. It sounds like a good idea.” But I really didn’t give it much credence. But there was something driving Sam. He wouldn’t let go. “John, you have to get that franchise. This is the future.” And those are the words he would use.

FROKE: He was talking, then, about the experiences that he had had in larger communities that did have access to broadcast television in 2 – 3 channels.

RIGAS: Correct. That’s exactly what he was saying. He saw the impact and the influence that broadcast television was on people and how they were migrating to the TV set. So after much pushing and harassment, the only way I felt I was going to get rid of Sam was to make that call. So I did make the call. I talked to the president of the borough council, and I told him I would like to apply to get a permit to bring television into Coudersport. I really didn’t, in my own mind, expect that I was going to do anything with it, but it was a favor to Sam. So the president of the council told me that I was too late. They had already given that permit or franchise, if you will, to another gentleman about three months before I had asked. I thought, “That’s good news. So now I can just relate that to Sam and be done with it.” So when Sam came up and I told him what happened, he immediately … Why I don’t know. Dumb idea at the time. But he said, “John, call him up and see if he’ll sell you that franchise because it’s the future. You’ve got to get it.” I said, “Sam, I don’t have time. I don’t have the money. It’s not for me. It sounds like an okay idea.” He kept on persisting. So I came to the same conclusion – that I ought to make the call to get rid of it, dismiss it. So I called up the gentleman that had the franchise. We were discussing what he had been doing. He gave me all the facts that they had tested for the signals on top of the mountain and they were receiving three channels, two of them pretty good, one pretty bad. Doctor Mosch and Senator Berger and Joe English were going to invest the money in it, and they were going ahead with the project, and everything looked in order. They had already begun discussions with Jerrold Electronics to install the system. He said, “Do you have any interest in investing some money in this project?” I said, “No, not really. I just thought maybe you’d sell me the franchise and let me see what I could do with it.” He said something that I’ll never forget. He said, “Yes, I’ll sell it to you.” I thought, “What?” I heard this litany of …

FROKE: … of all the good things that were happening.

RIGAS: … all the good things. That’s not what I wanted to hear. True. My heart dropped right down and I said, “Didn’t I hear this story of everything.” He said, “Here’s where I am. The other three gentlemen insist that I have to put money in it, hard cash. I don’t have any cash. I’m just a little storekeeper.” In those days people that were looking to sell their TV sets were people that were, in small towns, that weren’t getting TV reception. So it was an ordinary thing. That’s what John Walson did and Bob Tarleton. So here was this little TV dealer trying to bring the signal in and trying to sell his sets. But he said, “I don’t have any money. They told me that if I didn’t come in with what they put in, that it wasn’t going to work for me. Then I told them I’d sell them the franchise and they told me it wasn’t worth the paper it was written on, and they didn’t need that. My lawyer and the borough council are telling me that they can’t cross those streets so I think I have some value.” So I said, “Well, okay. What would you sell it to me for?” He said, “I will sell it to you for $300.”

FROKE: $300?

RIGAS: $300. I couldn’t say no to $300 so I overdrew the checking account – which is true – and I had a franchise. So there’s the …

FROKE: That’s the beginning.

RIGAS: That’s the beginning. But I also will tell you this. Let me tell you the last part of that story because, in all honesty when I look back on it, I really didn’t think that I was going to do much with it. I didn’t have a clue, didn’t give it any thought. And about two weeks after I had purchased that franchise and bought it from Jack, I got a call from one of the gentlemen that we had mentioned that was interested. He said, “Can I have a cup of coffee with you?” And I said, “Sure.” Of course I was just a young man, about 26. This was an older person in his forties. Like so many young people, we look up to an older person. So we sat down and had a cup of coffee. Then he kind of blurted out, “You can’t keep television out of Coudersport and protect your theater.” The spin on it was that I had bought this franchise to keep television out of Coudersport to protect …

FROKE: Oh, to protect the motion picture theater.

RIGAS: Yes. I said to him, “Joe, I wouldn’t do that, and I don’t expect that I could keep television out of Coudersport at all, and I wouldn’t do it.” So he said, “What are you going to do with it?” I said, “Well, I am going to begin to investigate it to see what I can do to introduce television in Coudersport because my sense is that there is interest in this project.” So like getting into the Coudersport Theater, I saw it as an opportunity, a start – nothing venture, nothing gained. Once again, I didn’t really dismiss it but I didn’t know which direction I was going to take. Then he told me it wasn’t worth the paper it was written on. I said, “I think there’s some value there because I think the best way to do this project is to cross those streets. You can possible do it by going from tree to tree, but I do have that license.” The long and short of it is – he said, “Well, John, if you’re willing to throw in that franchise, we’ll give you 25% of the company and we’ll all be equal partners and you’ll help us build the system because you have some technical background. None of us do.” I said, “What will that entail in the way of cash infusion?” He said, “Jim Burger is a director on the local bank and he’s made arrangements to borrow $40,000 which will more than get us started. Would you sign the note? It won’t take any cash.” That sounded pretty good to me. The problem was solved that I didn’t have to worry about finding cash and at the same time I formed a partnership that had some substance in the community – which I didn’t at that time. So we started down that road and built a cable system. We hooked up our first customer in March, 1953. I started the discussions in ’52. Technically, my first customer didn’t come on till ’53.

FROKE: Did you sign the note for the bank loan of $40,000 then?

RIGAS: Correct. We all participated in that.

FROKE: So it was an obligation not only for you but also for the two other partners.

RIGAS: Yes. It was the beginning of a long history of signing bank notes all my life. I often said that if they ever put all my bank notes through a computer, it would choke it. For the first 30 – 35 years …

FROKE: It was tough.

RIGAS: … you just signed whatever asset you had to get the money to get started.

FROKE: The name of the corporation that you chose is Adelphia which obviously, then, comes from the Greek tradition. Did your brother come into the operation at that time?

RIGAS: My brother came in …

FROKE: “Adelphia” meaning “brother”.

RIGAS: Yes. My brother came in in 1954. At first I didn’t understand the business, and I just thought it was a short-lived project. I remember my first salesman that I ever talked to about equipment was Milt Shapp who was the founder of Jerrold and who later on became 2-term governor of Pennsylvania. One of the things that Milt was saying to me was that we aren’t sure that this industry, if you could call it an industry, is going to be around very long because at that time the FCC was studying, and put into a freeze mode, whether they wanted to issue more VHF licenses or go to all UHF. So as soon as that decision is made, there’ll probably be a proliferation of TV stations coming to all these towns, and there wouldn’t be a need for television by wire. But what I learned is after a year, one of the things that I began to realize, very subtly, … and my partners that I had in Coudersport, never really felt this – and this is one distinction is that I’ve had partners that a lot who, when they could exit and make a few dollars, exited. But what I sensed is that in listening to people like John Walson and Joe Gans and George Barco, that people wanted choices. So, yes, we only had two channels in Coudersport. And, yes, in Wellsville, where we were going to go next for our second endeavor, is that Wellsville had the three networks with 6′ or 10′ antennas. But there was also now beginning to come on the horizon microwaving signals from New York and we began to realize that this business was not going to go away, as some people thought. In Wellsville, the gamble was that they were getting three channels in most parts of the town. That’s my home town, and my brother was now involved in the restaurant with my dad. We talked it over, and I said, “Would you like to a partnership?” He said, “Fine.” So we went to the village board and asked for a franchise. At the same time – now this is about ’54 – we built a system in ’55. Like I suggested, we could bring in two other signals so we could bring in five. The technology was, at that point, only capable of passing five signals. A few years later we went from five to twelve to twenty and so on. But – there the risk and gamble was, “Why do you think that with two more channels, duplication of the same networks because they didn’t have PBS, …” I’m trying to make sure that everybody understands that we began to believe that we were going to bring in distant signals, and we going to be able to find a technology that would pass us more than five signals. It was also an element of where we said, “There are pockets in this little village that are behind the hills, are located where they don’t get good reception.” We felt that we could give a better picture than sometimes was coming off an antenna. So we put that all together. So my brother and I joined a partnership. Later on we called it Adelphia which is the Greek word for “brothers” out of respect for our parents and now, after some 20 years, my sons are brothers and it’s still apropos. I must say the name “Adelphia” had a pretty good ring all these years.

FROKE: It’s got a wonderful feel about it.

RIGAS: Yes.

FROKE: Did your brother manage the Wellsville station?

RIGAS: He did.

FROKE: And you maintained the management of the Coudersport facility.

RIGAS: Right. What had happened is that Gus became very good at understanding the technical aspects and really managed Wellsville and built that system. He’d draw on my experience. Then I began to think that maybe I ought to leave my engineering job, which I did, and focus in on getting other franchises and working on the finances and understanding the business better. Building that system in Wellsville, …. Another things that I think that’s kind of interesting to me is, as silly as it may seem today, one of the things that I was hung up on and I told my brother Gus, “When we go to the village, we should get a franchise for 100 years.”

FROKE: All right.

RIGAS: And the reason was, there was always this fear that we were starting to hear that they could take this franchise away. There were no rules or regulations. So if somebody on council wanted to do a favor to somebody else and could say, “We’re giving this franchise to this person – you no longer have permission to service this community,” could they then force us to get off and just drop the service. That was a real worry!

FROKE: Sure, sure. The franchise problem has been, from the very beginning then, a serious one for the cable industry. You mentioned that you were concerned about Wellsville. You and your brother talked about the possibility of a 100 year franchise there. Could you carry that story …

RIGAS: Yes, I think it’s a…

FROKE: Did they give it to you?

RIGAS: We got it for 99 years. Although I must say that after a few years into it, I still have it framed someplace. That’s kind of special. It’s very difficult to find the words and to press upon people how frightening that was to all of us. Here we are, risking what little we had and believing in something so passionately and so important, signing those notes, mortgaging your home, mortgaging whatever you had, and knowing that you could never pay off that note if something was taken away. That’s a terrible fear. So when you would go to city councils… In those days, the early days, we didn’t enjoy the technology that we have today. The pictures were marginal. Like I’ve said, in Coudersport we promised two clear pictures. Our ads in the papers said, “Two clear pictures, better reception.” But actually they were both snowy, intermittent, co-channeled where two signals would buck against each other and wipe them out. That was a huge problem. Then the council would get complaints. Then they would call you up before a council and say, “You’ve given us bad service, it’s being interrupted. You’re out of service for a day. You’re out of service for two days.” And yes there were times when we were out of service for a day or two. One, you didn’t have a skilled technician. Two, you didn’t know where the problem really existed. It may sound silly. But then you go in there and they say, “Well, here we got these other people that are promising better television, and we’re going to give the franchise to them.” Terrible.

FROKE: The threats were not subtle. They were very direct.

RIGAS: It really was. Just backing up a little bit …

FROKE: There’s a limit to how much you can take in risk in terms of financial investment.

RIGAS: The whole history – if you look at the first 30 years up until we got the satellite pictures – it was always an issue because pictures were very difficult to maintain and balance the systems. You didn’t have the fiber optics. You didn’t have the state-of-the-art that we do now. Balancing the system was a huge problem for all of us. Now we never talk about “balancing the system.” Backing up to where we started in Coudersport, there are a couple of things that people I hope would understand. Contrary to what you would think, in Coudersport we promised to give them two channels. That’s all we could receive. We tried for three but we couldn’t get the third one. The two channels were reaching out 90 – 100 miles so the signals would come and go and fade. But it was the best we could do. We decided to charge $150 to hook up. The premise was that a lot of it was based on the fact that we better get our money up front because we didn’t know if we were going to be around much longer so try to get it up front. So the monthly fee of $2.75 wasn’t really going to make much difference in the long run. As a consequence, in Coudersport, people started to string their own lines off the hilltops with the theory that this week it’s my turn to maintain he line on this street. Next week it’s your turn. We won’t have to pay that cable company anything, and we’ll save that money. The $150 was definitely the wrong move. It was a deterrent. So after the first year, we didn’t get a lot of customers. We had to find what was the best way to market in Coudersport. What we found was that $150 went to $125, to $99.50, $75 to get them on. Our signals weren’t all that much better than the signals they were getting …

FROKE: With their neighbors.

RIGAS: …with their open wire and whatever they were using for awhile. But after awhile, people got tired of whose turn it was to maintain. So that was something we had to overcome. Now in Wellsville, what we were faced with was, at times, pictures that weren’t holding up. We got a lot of complaints. It’s the nature of the business. It was a heartache. My first operator that I had that stayed with me that maintained the system in Coudersport was my projectionist. On weekends when he was running the movie, the TV would go out. No way was I shutting down. And by the way, he wasn’t going to go out anyway. It was very hard to get ____ these people. Later on the people that we hired devoted so much of their lives and talent, and they believed in it. That’s why in today’s environment, I tell a lot of our employees, “You have a legacy here that was based on people believing in this industry and giving of their talents with very little compensation, no benefits, working night and day to keep it going, getting beat up.” If you want to talk about humility and being paranoid, you look at a cable operator in those older days because he was just being beaten up every time he stopped in for a cup of coffee – bad pictures, threatened to lose a franchise, telephone companies weren’t letting you on the poles and if they were, they were charging exorbitant fees to make ready that was clearly just deliberate. The broadcasters were starting to reach a point where they didn’t want you to bring in distant signals and so on.

FROKE: What you’re portraying very effectively, John, is the requirement of anyone starting out in business to have a great deal of persistence and intention to stay with a project until it really plays out. You wanted to make sure that all of these difficulties were really solvable, and you were not going to be put down by them until it was really necessary to be put down. So the value of persistence in starting any new business is one of these factors that I think you’re effectively describing.

RIGAS: It goes back to the people in the ’50s and the ’60s and the ’70s. The people that service this industry from the very top and from the people that were vendors and technicians and the people that just work in the office making the collections – all of those people really and truly believed that what they had to offer was the right thing, the right way to go, and they weren’t going to be defeated. They were going to fight that battle. When I mention people that I had early on – there were so many – that fought those battles so strongly. We wouldn’t be here, I’m fairly convinced, if they didn’t take up that at every level, not just the local, but the national level, the FCC level, the state level. All of the associations, state associations and the national associations helped us along the way. I well remember Strat Smith was one of our first counsels for our association and fought that battle as a community antenna TV. George Barco fought the copyright issues, and Yolanda fought along with him. Milt Shapp worked on equipment. But John Walson and Bob Tarlton explained to my why the coaxial cable had something that the broadcasters couldn’t have – that was that broad spectrum. To this day it’s interestingly enough, I firmly believe we still have, at the end of the game, a great advantage of that broad pipe. Yes, fiber is here. But the last 200′ or whatever it is, we still have the coaxial cable that has served us so well.

FROKE: From the very beginning then, you appreciated the broadband significance of cable.

RIGAS: Truly. And I guess if I did anything right, …

FROKE: You played for that.

RIGAS: … and I believed in that. I think that when I say people wanted choices, I got to realize people to this day … Here we are. We started with two channels, went to 5 channels, went to12 channels. People were saying, “What are we going to do with 12 channels?” Then we went to 20 channels and 35, 55 and 110. Now with compression we’re talking about 200. And you know what? We still hear the same thing. When is … I haven’t got anything to watch! And that’s partially true because we’re flitting around and we can’t focus on anything long enough to make it interesting, sometimes by nature. They still want choices. They want to be in control of their environment.

FROKE: I would like to go back again, just briefly, to some of the things that you have said about the attitude and characteristics of the early cable operators. You and the others of that time period came out of two turmoils in the United States. One of the obviously was World War II which you made reference to. Then the other one was the depression – the economic depression. Both of those, then, were personal and national tragedies. To what extent did those play on the attitudes that you cable people brought to the development of your industry?

RIGAS: I don’t want to sound arrogant about this because I go back to Tom Brokaw’s book about the greatest generation. That kind of caught on with a whole lot of people. My sense is that what the people had picked up on – it really was a special generation. That generation was built on a depression. They weren’t given much, but they were built on a lot of strong character and perseverance. Then the war was an effort that we all united and were part of. That working together, that spirit of being and having strong values and faith, like I’ve suggested, sustained and built [our country]. The people that exited World War II and the homefront weren’t people of inherited wealth that came into this business. They were just people, American people, with a dream and hope, not looking for a handout.

FROKE: Not expecting one.

RIGAS: Not expecting one. So if you ask me what the people were, they were an extraordinary generation. You know that I believed made a difference in the early years. How do I find the right words to express it? I can’t always reach down. But I will tell you this: when you ask about the soul and the fiber of cable industry, it’s been built on people that were visionaries, entrepreneurs, had great work ethics, and believed in the American dream at every level. So I think that still is here because I see so many young people that are aspiring and believe in what they are representing and who they’re representing at every level – programmers, creative people, vendors, and small people. We still have a lot of little people that are getting started and God bless them. Part of what I see is that I have to do what my mentors did in the 50’s and 60’s to kind of make sure that the message that Bill Daniels was preaching remains, the Barcos, Ralph Roberts, Alan Gerry, and all those people.

FROKE: I’d like to go back and pick up on that franchise up in Wellsville for just a half a minute. I think you were about ready to say that at some point along the line you went back to the City Council and renegotiated the 99-years. Am I correct in that?

RIGAS: That’s correct. After some 20 years, they felt that … You know, in the context of things, I didn’t think I was taking advantage of them.

FROKE: So despite all of the difficulties related to franchise and some of those early problems in cable, there was a certain amount of goodwill on your part to the City Council up in Wellsville.

RIGAS: Yes.

FROKE: Along that same line, John, when I saw you last you were concerned because the council in Coudersport had not reacted positively to your suggestion that the parking meters in front of your new, beautiful headquarters building be taken down as a matter of aesthetic appearance. Today as I drove by, I saw that those meters were down. What did you do to get them down?

RIGAS: Oh, …

FROKE: Maybe I better not ask.

RIGAS: No. I felt pretty strongly about parking meters. There was a place, but I’m not a big believer in parking meters. They cause so much animosity with people, but I won’t get into detail. I said, “Look, in front of our property, we’ll pay you the year round for what you would generate and just get them out of there.”

FROKE: It does make a better look to your building which you’ve done a remarkable job on as you’ve done with everything.

RIGAS: I want to back up a little bit, and then I’ll move on to probably some more important thing. When we were building the system in Wellsville, I began to start to look for other franchises. I’d get on the road and travel all night and make my pitch. I remember in Erie, Pennsylvania, I went there to visit it – in 1957 – and there were antennas 6′ – 10′ high. I said, “Wow, this has got real possibilities.” Now microwave was coming in, and I could bring in New York. New York City said that I could reach out and get the Cleveland signal. Erie had two stations at that time. I had spent a lot of time, going back courting the city officials and the mayor, trying to educate them as to the possibilities of bringing in cable television. I had one council member that didn’t see any reason why we shouldn’t have cable television. We were going to bring in three channels from New York and three channels from Cleveland and two from Pittsburgh. So we were going to give them in those days 12 channels. That was pretty darn good. We had the first reading at council and they approved it. The second reading was approved. Then one day I got a phone call at my office from the radio station. “Do you have any comment on what happened at council?” I said, “No, what happened at council?” He said, “Well, your application for franchise was turned down, refused.” I said, “It was? Why?” What had happened is that at that time the UHF station which was local and owned by primarily the people that had the newspaper, had convinced the mayor that the future was in UHF stations, that they didn’t need these other signals and people didn’t need any more than these two channels. So they bought into it. I remember going to the gentleman that was representing this other group that had the station, and I said, “Why don’t we do a partnership? There’s a great future here.” “No, the future is in UHF and cable didn’t have any future.” But the point is that we had a lot of that. So Erie didn’t get cable for about another 20 – 25 years. It was delayed for that long. Also, going to that, spending a lot of time, you didn’t have money, traveling by car, … So the ones that believed in it were trying to find little nooks and places where there were antennas and you could get some franchises going. Going back to Wellsville now, we dropped the price from $75 to $37.50 and then we went down to $25. One of the best marketing tools that we had was that we weren’t getting them on as fast as we would like. People were staying with their antennas. So we came up with the idea paying them $37.50 for their antenna. If we could buy their antenna, …

FROKE: … They would then have free …

RIGAS: … then we had them hooked because we took the antenna off the roof. So I had the biggest graveyard of antennas that you can imagine. But it got the job done eventually.

FROKE: One of our mutual cable friends made a remark to me several years ago that cable was the most environmentally sound industry in the country. An example of that is the taking down of those household antennas which were really eyesores. They were really eyesores.

RIGAS: Yes. We used to have a little advertising that I always liked. It showed a picture of an antenna with the birds nesting on it. We used to say, “Antennas were for the birds.”

FROKE: The other point – I want to get you married, John. When did that happen and how did that happen?

RIGAS: The marriage?

FROKE: That you and Doris were married, yes.

RIGAS: Doris and I were married in 1953, February 1.

FROKE: That was before the Coudersport channel went on the air.

RIGAS: Right, just before we hooked up our first customer.

FROKE: Was Doris a resident of Coudersport?

RIGAS: No, she was a school teacher in Wellsville, my home town. I began seeing more of Doris when I got out of college so we decided to get married Feb. 1. February 1 in my life is a pretty remarkable date because on Feb. 1, 1946, I was discharged from the Army and that was an extraordinary feeling. Then Feb. 1, 1950, I graduated from college, I got my diploma, and our commencement speaker was Omar Bradley. Then Feb. 1, 1953, I was married.

FROKE: So you can remember very significant anniversaries just by keeping the first day of February in mind.

RIGAS: That’s correct. And probably the best friend I had growing up as a boy, his birthday was on February 1.

FROKE: Wonderful. Is your brother Gus still living?

RIGAS: Sure.

FROKE: Is he still active in the cable business or has he retired?

RIGAS: No. He retired after 22 years. What had happened was the world was changing. There never was much of a market. There’s where Bill Daniels and people like him that …. I’ll never forget how important it was when I heard that Bill Daniels had acted as a broker to sell the systems in Olean, in Brandford, in Clearfield, to a gentleman by the name of Joe Sarax from Fairfield. He established a market. He got $100 a subscriber! Wow!

FROKE: Let’s come back to that in just a little while here. We’re going to take another break for just a minute or so.

RIGAS: Okay.

FROKE: We were talking about your brother and his 22 years within the cable industry and then making a decision to retire. Could you pick up on that just a little bit more?

RIGAS: First of all, my brother was an extraordinary partner. We’ve had a lot of partners, but he had the ability to understand a lot of the technical aspects quickly. He had a natural ability. He had the ability because he was involved with people in the restaurant – what was important to them, what the pricing should be. He had a wonderful, out-going personality. As important as all that was, … As I was going out – reaching out, and we were taking all kinds of risks to get franchises and trying to raise money at the local bank because we didn’t have investment bankers and money cities that were loaning us in the 50’s and the 60’s. It wasn’t until the early 70’s or late 60’s that I began to get some interest from some city banks. There were actually a few coming to you. But in the early days, you had to go to the banks and try to get $20,000 or $40,000 in our case, to get started. The important thing about Gus is that all those years, he was a great, great supported and believer in the future industry, just like all the other people I have mentioned. Sometimes if I was hesitant and I was getting a little fearful, he would be the one that would say, “Do it. Go get it.” I needed that. I needed a person like John Walson. I often remember, because in the context of things, you could go to the Pennsylvania and New York board meetings, particularly Pennsylvania, and the news was so bad because we were just being …

FROKE: … Bled to death, yes.

RIGAS: … beat up all over. You just wondered if there was really a future, if we were going to be able to survive. It was scary out there because you had everything signed personally. I would go to a person like John Walson who was older than I was but was a great visionary and a risk taker that made the fiber of cable what it was. He understood what it was to have that broadband pipe. When I would get discouraged, he would start to enumerate why it was that broadband pipe was going to be able to survive over the broadcasters. We were going to be able to bring in these signals. Then he would turn to me and he would say, “John, you know, are you afraid of the future?” I said, “Well, God John, there’s a lot of uncertainties out there.” He’d say, “Well, John, I’ll buy what you’ve got. I feel confident.” I thought that if John felt that way, I think I’ll stick around. So I stuck around.

FROKE: Is it accurate to say that Gus retired at about the same time you were able to bring your three sons into the organization?

RIGAS: That’s exactly right. Giving a lot of credit to Gus and giving a lot of credit to all kinds of partners, …. In those days when you were looking for franchises, one of the best ways for us to do was to partner up with somebody that was local. That way it would help the council to justify giving it to us. So it was a local business in many ways. So we had a lot of partners along the way. A lot of them have exited for one reason or another. But Gus came to a point, where getting back to where signals or systems were being sold for $100. Then by the time in the 80’s we had the introduction of the satellite services and the investment world started to take note of the great future out here. We went from $100 a subscriber to $300 and that was a plateau. Later on we were …

FROKE: … $1,000

RIGAS: We were still struggling. We never had any cash. We had $500 a subscriber. They we got to $800. Whoa.

FROKE: $1,200?

RIGAS: We got up to $1,200. Gus said, “You know, I’ve been struggling with this. I think I’d just like to do something else.” But at the same time, lucky for me, Tim and Mike started to come in the business. Through their efforts, and now James and now Ellen, the family’s involved, all making a contribution – a huge contribution. Probably I wouldn’t be here at this long date, but the family has brought it to a different level, no question about it.

FROKE: You were serving as chairman and Chief Executive Officer which leaves no doubt as to who is in charge. Then I believe that Mike is the Senior Vice President?

RIGAS: I think we just made Michael and Tim CEOs of Adelphia Broadband. James is CEO and Executive Vice President, along with Tim and Mike, of Adelphia Business Solutions. Up here someplace, vaguely, is John Rigas, Chairman and CEO of …

FROKE: … all right. All right.

RIGAS: … So we just did that last week.

FROKE: So you’re separating, in a sense, your video service from the other entrepreneurial enterprise activities.

RIGAS: Sort of, but I think there’s so much to be done out there and a challenge. I’ve never been one that understood all the importance of … After all, we grew up, we didn’t have titles so that’s never been an important factor in my life.

FROKE: But they obviously have taken a very significant role in the development of the company now.

RIGAS: Wouldn’t be here. I’m so fortunate because they all have extraordinary talent. I say that with all humility. It’s just not nepotism. It’s just that they’re good at what they do, and they believe in it. I’ve listened to some of their views and interviews, and it’s kind of interesting how they’ve picked up on what was important. They’ve never really talked too much. But now I have this knowledge that they’re as strong about entrepreneurship and the future and that’s just great!

FROKE: Freedom and choice are still very significant for them.

RIGAS: That’s correct, and that’s what it’s all about.

FROKE: Is Doris active in the company in any way whatsoever?

RIGAS: Doris has taken an interest. Well, she always had an interest in the company. That’s another thing that I perhaps ought to dwell on – that in the 50’s and 60’s there were very few women that I dealt with in the industry. Today it’s a wonderful story to see how many people are at the managerial level, at the senior management level, entrepreneurial level, programming and creative and finance levels. But I want to make a point that the women in the 50’s and 60’s had a different concept of what their role would be. That was mothers. But they made a huge contribution and Doris did too. They were so supportive. They were home raising the children while you were out there on the road, night after night perhaps. They would take care of the office, take the calls at home from an irate customer, dispatch somebody. So they had an extraordinary role. And Doris did that. Beyond that, many times when I’d say, “I really don’t feel I want to go to that meeting,” or “I shouldn’t go to get that franchise. I’m kind of tired.” She’d literally shove me out the door and say, “There’s where you belong. Go get it.”

FROKE: That Tim and Michael and Jim were able to move in, along with Ellen, and provide, in effect, the next generation of leadership for Adelphia is directly traceable to her dedication to raising the family.

RIGAS: When it’s all said and done, it’s about people. Our customers are people that are very dear to me. I’ve grown up as a mom-and-pop operator, and I truly, truly enjoy talking to my customers out there and listening to their complaints and frustrations and growing up in that environment. The aspect of what is important – we look at the bottom line and we talk about the stock prices – I often remind people that I think one of the strengths, if not the most important strength, is the leadership is in place. Now it’s not just me. It’s my sons with a strong commitment, and they see the future. So the transition from one generation to the next is in place and there’s no uncertainty. After 20 years that they’ve performed, I think they have a great track record, and that is as important for the future of Adelphia as anything that you can talk about.

FROKE: The values that you have talked about and are so important to you, have obviously with you and Doris have been carried on to your children which makes you feel good.

RIGAS: It’s really about family, isn’t it, when it’s all through? We all sense that, and we feel that. The cable industry was a family, small in concept. It’s still a family. You can go around and talk to people and they have that same feeling. But there’s value there. I think that the industry has had extraordinary integrity and values. At the end, they were really interested in serving and doing what’s right for the customer and our society. It really was! They weren’t so self-serving that they were just looking out for themselves. Even today that’s paramount. I believe that.

FROKE: You mentioned earlier that Doris had been a teacher in the school system in Wellsville. Does that have any relationship at all to the attitude that you and your sons bring to the public service nature of cable? In other words, I can go back and look at some of the things that Adelphia has done in supporting education on a state-wide basis and on a national basis. Adelphia is out in leadership in terms of the literacy movement. Adelphia is out in leadership in terms of the state public affairs and education network, and I can give other examples. Does some of that come from an influence that Doris had with you?

RIGAS: Oh, I think so. I think it comes from the fact that Doris came from very humble beginnings too. There was not one family of any wealth. She worked her way through college, and she had great work ethics. But along with that, she was a strong believer in people and in helping people. That’s carried on. Those values, I think, … My humble beginnings with my parents …. Even a small thing that I remember in the restaurant – in those days they had people they called bums. They’d come into the restaurant and Dad would give them a couple of doughnuts for breakfast and the coffee, a couple of hot dogs at lunch, sharing and all of that. I think that there was something special about first generation – Doris’s family was first generation. Giving and understanding people and their needs is part of all of that. That’s some of the value that Doris definitely brought to the table, no question about it.

FROKE: At what point …

RIGAS: She has another thing, if we’re going to talk about Doris. She had an extraordinary, unbelievable amount of energy and stamina. Where I might be going to bed, she was up there at night helping the children prepare for school the next day, getting their clothes ready, helping with their homework, whatever it took, and getting me started in my job. It took a lot of energy. A lot of mothers and people in that generation – that’s what they did and they did it well. I can look at the George Gardners and the Joe Ganses, Irene now still a big part of that – how important a role women played at a different level – but it was huge. God bless them.

FROKE: Michael went on to get a law degree. I don’t think that I know the educational careers of your other two sons or Ellen.

RIGAS: Do you want me to talk about a little bit of that?

FROKE: Yes. Would you talk a little bit about it?

RIGAS: Okay. Well here we are in Coudersport. A lot of that goes to what I just mentioned about Doris. Yes, I gave certain standards and values and believed very much, and Doris believed in them. So from that we had a good beginning. I had four children, and they all went to the public school system in little old Coudersport, Pennsylvania with graduating classes anywhere from 60 – 80. Now you only graduated with a class of 5, and you were valedictorian. I’m going to put that in.

FROKE: In Vienna, South Dakota. And it wasn’t until I got in the military that I learned there was another place called Vienna.

RIGAS: Okay. It’s a little larger, isn’t it?

FROKE: Go ahead.

RIGAS: Okay. So the older son was Mike, and I’m not … But I want to give them credit because I think they deserve credit and I owe it to them. But Mike went to Harvard undergraduate school. Then he stayed on and went to Harvard law School. Then Tim went to the University of Pennsylvania, Wharton School of Finance. Then James went to Harvard undergraduate, went on to Stanford and got his degree in law and his Master’s in economics. Ellen went to Harvard undergraduate. So all of those just coming from this little community. Obviously mother helped them with her abilities.

FROKE: And all four succeeded.

RIGAS: Yes. They did pretty well. But I want to share a story that maybe doesn’t fit in to cable, but there’s a message here. When Mike was applying for college, reading all the catalogues that we brought to him, one day I remember he said, “Dad, what do you think about me applying to Harvard?” We were looking at more of the traditional schools near here. I said, “Well, why not.” So he applied and was accepted. So one day I said, “Mike, why don’t we go up and visit Harvard. I’ve never been on campus.” We’ve never been ones that promoted Ivy League schools. We just felt that we wanted them to go to the best schools that they could go and make sure that they got their education because that was paramount. If there’s anything inherent in my family’s immigrants and all the immigrants I knew is that education is paramount. That was critical. You see so many successful first, second generations of immigrants that have done so well. So we went up and visited Harvard. AT the time, there was a demonstration going on. It was a dreary day, rainy, and the demonstration was that they didn’t want Harvard making investments in Africa. We visited a couple of dorms, and they were pretty unkempt. As I recall there was a ham sandwich on the floor that was probably there for two weeks. Nobody bothered to pick it up. So we weren’t sure we got the right image. So on this particular Friday morning, I said to Mike as he was getting ready to catch the bus, “Mike, today’s the last day. You have to give a decision whether you’re going to accept Harvard’s invitation or not.” Mother’s in the background saying, “I think you ought to go to Harvard.” I’m saying, “Well, it’s your choice, Mike. It’s whatever you want to do.” Mike said, “Well, …

FROKE: …but don’t forget that ham sandwich on the floor.

RIGAS: And Mike said, “Well, I think that probably coming from a small school, I don’t know if I’m up to the work, and I don’t know if it’s too intensive. It’s a big school. I think I ought to pass, and I’d be more comfortable in some other school that was nearer home.” So I called up the Admissions Office about noon. Some lady answered and I told her that my son had been accepted into the class of ’76. She said, “Congratulations. You must be very proud. You know that that’s quite an accomplishment. How can we help you?” I said, “Well, it isn’t that we aren’t proud, but we just want to inform you that Mike isn’t going to accept the invitation.” And she said, “Oh, we don’t like to hear that. You know that. Why is that?” So I went through the reasons that I suggested here. She said, “Well, we hear that all the time about different students. But we know he can do the work, and he belongs up at Harvard. If you wait a few minutes, the Dean of Admissions will call you up.” I said, “No, I don’t think that’s necessary. We don’t expect that.” She said, “No, he’ll want to talk to you.” So the dean called and talked to me. He invited Mike and I to come back up and revisit the campus and stay there three days. He extended it for two weeks. When Mike got off the bus at 4:00, I told him what had happened. My recollection, Mike went in his room, thought about it, came back out and said, “Maybe I ought to go to Harvard.” So that’s why he went to Harvard and that’s why a lot of the other children went to Harvard.

FROKE: He needed a gesture of confidence from someone – from you and from the Harvard University people.

RIGAS: Yes.

FROKE: With the cable industry’s growth, and you now in a position with a cable operation in Coudersport and one in Wellsville, and you’re traveling around the United States, at what point did you decide then that Adelphia would become a national, multi-system operator. Was that a conscious decision on your part that you were going to spread out from Pennsylvania and go into other states? What were the opportunities that came up?

RIGAS: It was a decision from practically the first 35 years to continue to grow it where we could, based on a philosophy that we could cluster as best we could and not just grow across the nation helter skelter. So the years in the 80’s when we were acquiring… And by the way, the industry went through … Most of us grew up by getting small franchises, applying for franchises and competing for them in the 50’s. Later on, there became a situation where in the 80’s we grew by acquisitions. We’d purchase systems. Our philosophy was that, where we could finance it and yes, the leverage was high, but we felt confident that we could make that work and the revenues and the future, although it was a challenge, but it would work in a few years. It was just like we did in the early years. So we stayed pretty much on the eastern seaboard with our properties. Then there wasn’t a big game plan that we should become national, but the opportunity presented itself. The family looked at it together. A lot of cable operators had chosen to exit. Some of them preferred to deal with the family, and because they knew of our strong commitment to this industry, they were kind enough to put their lot with us. They could have probably have gotten more money or if not, certainly had more certainty, with other MSOs. When the opportunities came to become national, we felt that was the right time, the right place because of the clustering that was made available clear across this country. Then it kind of complimented itself with what we were doing with the broadband network and Adelphia Business Solutions where we’re creating a national presence to offer all the voice data to our commercial customers. It wasn’t that we set down 20 years ago. It just … It never was my ambition to be the largest. I just wanted to survive. Somebody asked me, “What do you think of when you think of your biggest contribution that you made to this industry or you did?” The one word comes – survival, just surviving.

FROKE: Did Bill Daniels play a part in the growth of Adelphia beyond the local operations?

RIGAS: Absolutely.

FROKE: He would call to your attention, then, some opportunities that he thought you ought to look at.

RIGAS: He did that. He did the intangible too, from my perspective. Bill Daniels was a giant in that he offered us hope. He offered us leadership when there was so little of that. He could see the future, and he led the battle as so few others did. But he was there. As the years went by and Bill stayed with the cable, on a personal basis with Adelphia’s relationship with his company to this day, we’ve have a great … where they presented us with wonderful opportunities, helped us to make the transition. Part of that was, to me, Bill had a great affection for Adelphia, partly because of where we were located and our start and what we believe in. So Bill was a big proponent of value, value for the customer and ethics. As the industry matured, Bill was there to lead us a way. In the beginning, he led us a way that we should stay with the business and believe in it. We had a little value, and he brokered it. But beyond that, later on, he became an inspiration at a statesmanship level.

FROKE: John, we’re going to have to take an extended recess in our conversations here in order to provide the opportunity for us to talk at length again with you at a later time and begin picking up on more of the details of your cable career and then your reflections on the future of the cable industry. But for this first session from the Brown Barn in Coudersport, I want to say thank you very, very much for being with us. We are speaking from the Brown Barn, one of the new facilities that the Adelphia Cable Communications Corporation has developed here in Coudersport, Pennsylvania. We’ve been visiting with John Rigas who is the President, Chairman, CEO, the top dog of Adelphia here in the Brown Barn offices. We want to express our appreciation to Hauser Communications of New York City for making this possible.